Since mid December, there has been a significant rise in aluminum prices, with Shanghai aluminum rebounding nearly 8.6% from a low of 18,190 yuan/ton, and

LME aluminum climbing from a high of 2,109 U.S. dollars/ton to 2,400 U.S. dollars/ton. On one hand, this is due to a market trading sentiment optimistic

about the U.S. Federal Reserve’s interest rate cut expectations, and on the other hand, there has been a sharp rise due to the cost-side increase in alumina production cuts compounded by the Red Sea crisis. This rise in Shanghai aluminum has broken through the fluctuation

range formed over more than a year, with LME aluminum showing comparatively more weakness. Last week, as some alumina manufacturers resumed

production, easing supply concerns, both alumina and aluminum prices experienced a slight retraction.

1. Bauxite ore Supply Shortages Will Still Restrict Alumina Production Capacity Release

In terms of domestic bauxite ore, the operating rates of mines are naturally low in winter. A mine accident in Shanxi at the end of last year led many local mines to suspend

production for inspections and repairs, with no expectations of resumption in the short term. The Sanmenxia mine in Henan has also not reported a resumption, with

decreased ore output in Pingdingshan. There are fewer new mines opened in Guizhou, and bauxite ore supply is expected to remain tight for an extended period, which will strongly support alumina prices. Regarding imported ore, the impact of the

fuel supply shortage due to the Guinea oil depot explosion continues, mainly reflected in increased fuel costs for mining companies and rising sea freight rates.

Currently, it’s the peak period for Guinea ore shipments. According to SMM, last week’s alumina ore shipments from Guinea amounted to 2.2555 million tons,

an increase of 392,900 tons from the previous week’s 1.8626 million tons. The tense situation in the Red Sea has limited impact on alumina ore transportation,

as around seventy percent of China’s alumina ore imports come from Guinea, and shipments from Guinea and Australia do not pass through the Red Sea.

The impact may be felt on a small portion of alumina ore transportation from Turkey.

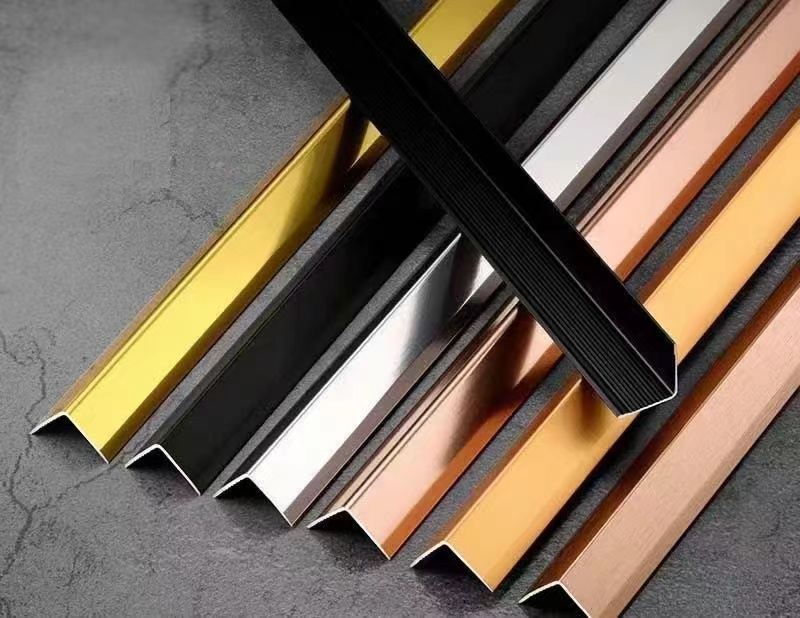

aluminum profile Due to shortages in alumina ore supply and environmental production restrictions, there was a significant drop in alumina production capacity earlier on. According to Aladdin, as of last Friday, the operating capacity of alumina was 81.35 million tons, with an operating rate of 78.7%, noticeably lower than the normal range of 84-87 million tons in the second half of the year. Alumina spot prices have risen along with futures prices. Last Friday, the spot price in the Henan region was 3,320 yuan/ton, up 190 yuan/ton from the previous week. Spot prices in the Shanxi region increased by 180 yuan to 3,330 yuan/ton compared with the previous week. Last week, with improved air quality in some parts of Shandong and Henan and the lifting of heavy pollution weather warnings, several alumina companies resumed production, many of which are brands available for delivery. A large company in the Shanxi region that reduced its production capacity due to calcination problems is also resuming production, along with some other companies, which suggests that the tight situation for alumina spot goods in the short term may improve. However, the problem of insufficient ore supply is expected to continue providing support for alumina prices in the medium term.

2. Increased Costs and Profits for Aluminum Electrolysis

In terms of costs for aluminum electrolysis, aside from the significant rise in alumina prices, the prices of electricity and caustic soda have remained relatively stable. At the beginning of the month, a well-known domestic enterprise significantly lowered its bid price for aluminum fluoride, which led to a decrease in the transaction prices in the aluminum fluoride market. Overall, SMM estimated that at the beginning of January, the total cost of aluminum electrolysis reached about 16,600 yuan per ton, up by 320 yuan per ton from around 16,280 yuan per ton in the middle of December last year. With the concurrent rise in the price of aluminum electrolysis, profits for electrolytic aluminum enterprises have also seen a certain increase.

3. A Slight Decrease in Aluminum Electrolysis Production and Low Inventory Levels

According to the National Bureau of Statistics, from January to November 2023, China’s cumulative production of electrolytic aluminum was 38 million tons, a year-on-year increase of 3.9%. The output in November fell slightly to 3.544 million tons, mainly due to restricted electricity supply in the Yunnan region. As reported by Mysteel, as of the end of November, China’s built electrolytic aluminum capacity was 45.0385 million tons, with the operational capacity of 42.0975 million tons and a capacity utilization rate of 93.47%, a decrease of 2.62% month-on-month. In November, China’s import of raw aluminum was 194,000 tons, slightly less than in October, but still situated at a relatively high level.

As of January 5, the aluminum inventory of the Shanghai Futures Exchange was 96,637 tons, continuing the downward trend and remaining at a low level compared to the same period in previous years. The warrant volume was 38,917 tons, providing certain support for future prices. As of January 4, Mysteel reported that the social inventory of electrolytic aluminum was 446,000 tons, 11.3 thousand tons lower than the same period last year, indicating that the overall domestic spot circulation remains tight. Given the weakened downstream operations before the Spring Festival and the expected decrease in the conversion rate of aluminum water by electrolytic aluminum enterprises, the aluminum ingot inventory might accelerate in the second half of January. On January 5, the LME aluminum inventory stood at 558,200 tons, slightly elevated from its mid-December low, but still at a low overall level, slightly higher than the same period last year. The volume of registered warehouse receipts was 374,300 tons, with a slightly faster recovery pace. The LME aluminum spot contract saw a slight contango, indicating that the spot supply did not show significant tightness.

4. Weakening Demand Trend Before Chinese New Year

According to SMM, after New Yeay’s Day, the aluminum billet inventory entered into a rapid stockpiling rhythm. As of January 4th, domestic aluminum rod social inventory reached 82,000 tons, an increase of 17,900 tons compared to the previous Thursday. The concentrated arrival of goods during the holidays, the weakening downstream operations before the Chinese New Year, and the high level of aluminum prices that suppressed downstream purchasing, were the main reasons for the inventory growth. In the first week of 2024, the operating rate of leading domestic aluminum profile enterprises continued to be weak, at 52.7%, with a week-on-week decrease of 2.1%. Some building profile production rates and orders declined, while leading automotive profile enterprises remained at high operating rates. The photovoltaic profile market faced intensified competition, and order volumes also dropped. From the terminal perspective, the cumulative year-on-year decrease in new construction area and construction area from January to November showed marginal improvement, but the sales situation at the end consumer level remained weak. In November 2023, China’s automobile production and sales completed 3.093 million and 2.97 million units, respectively, registering a year-on-year increase of 29.4% and 27.4%, indicating a rapid growth rate.

5. Relatively Mild External Macroeconomic Environment

The Federal Reserve maintained the benchmark interest rate unchanged during the December meeting, with Powell releasing dovish signals, stating that the Federal Reserve is considering and discussing appropriate interest rate cuts, and the possibility of rate cuts has entered into consideration. As expectations for rate cuts strengthen, market sentiment remains relatively optimistic, and no significant negative macroeconomic factors are expected in the short term. The U.S. dollar index retreated below 101, and U.S. bond yields also declined. The minutes from the December meeting published later were not as dovish as the previous meeting’s sentiments, and the good non-farm employment data in December also supported the idea that restrictive monetary policy will continue for an extended period. However, this does not hinder the basic expectation of three rate cuts in 2024. Before the Chinese New Year, a sudden downturn in the macroeconomic landscape is unlikely to occur. China’s manufacturing PMI in December fell by 0.4% to 49%, indicating a weakening in production and demand indicators. Among them, the new orders index decreased by 0.7% to 48.7%, reflecting that the foundation for domestic economic recovery still needs to be strengthened.

Post time: Jan-22-2024