The monthly climate index report of Aluminum smelting indistry in China

Jul. 2022

The association of China non –ferrou industry

In July, the Climate index of aluminum smelting industry in China was 57.8, decresed by 1.6% from last month, but still remained in the upper part of the “normal zone”; The leading composite index was 68.3, decreased by 4% from last month. Please refer to the table 1 in the below -the Climate index of China aluminum smelting industry of the last 13 months:

Table 1. the Climate index of China aluminum smelting industry of the last 13 months

| Month | Leading composite index | Coincident composite index | Lag composite index | Climate index |

| Year 2005 =100 | Year 2005 = 100 | |||

| Jul. 2021 | 83.5 | 121.4 | 83.8 | 70.7 |

| Aug. 2021 | 82.2 | 125.1 | 90 | 70.9 |

| Sept. 2021 | 81.9 | 129.7 | 95 | 71.2 |

| Oct. 2021 | 81.6 | 132.8 | 97.6 | 70.5 |

| Nov. 2021 | 80.2 | 137.2 | 97.3 | 68.1 |

| Dec. 2021 | 78.9 | 140.6 | 95.8 | 65.1 |

| Jan. 2022 | 79.2 | 144.6 | 94.5 | 62.5 |

| Feb. 2022 | 81.1 | 148.4 | 94.6 | 62.4 |

| Mar. 2022 | 82.3 | 152.3 | 96.9 | 62.8 |

| Apr. 2022 | 80.5 | 156 | 101.4 | 62.3 |

| May. 2022 | 76.3 | 160 | 106.9 | 60.8 |

| Jun. 2022 | 72.3 | 163.8 | 112 | 59.4 |

| Jul. 2022 | 68.3 | 167.6 | 115.6 | 57.8 |

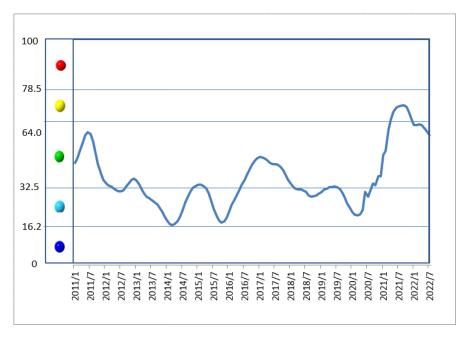

chart 1 the trend of the Climate index of China aluminum smelting industry

The climate index slightly drop in the “normal Zone”

In July, the Climate index of aluminum smelting industry in China was 57.8, decresed by 1.6% from last month, but still remained in the upper part of the “normal zone”; Please refer to the chart 1 in the below –the trend of the Climate index of China aluminum smelting industry

| No. | Item | 2021 | 2022 | |||||||||||

| Jul | Aug | Sept | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | ||

| 1 | LME alu. Settle price | O | O | O | O | O | O | O | O | O | O | O | O | O |

| 2 | M2 | O | O | O | O | O | O | O | O | O | O | O | O | O |

| 3 | Total amount of investment in smelting | O | O | O | O | O | O | O | O | O | O | O | O | O |

| 4 | Real estate sales | O | O | O | O | O | O | O | O | O | O | O | O | O |

| 5 | Electricity generation | O | O | O | O | O | O | O | O | O | O | O | O | O |

| 6 | Output of electrolytic aluminum | O | O | O | O | O | O | O | O | O | O | O | O | O |

| 7 | Output of Alumina | O | O | O | O | O | O | O | O | O | O | O | O | O |

| 8 | Main business income | O | O | O | O | O | O | O | O | O | O | O | O | O |

| 9 | Total amount of profit | O | O | O | O | O | O | O | O | O | O | O | O | O |

| 10 | Total amount of extrusion exportation | O | O | O | O | O | O | O | O | O | O | O | O | O |

| Comprehensive climate index | O | O | O | O | O | O | O | O | O | O | O | O | O | |

Remarks: O Overheat; O Heat; O Normal; O Cold; O Overcold

Table 2. the persperity signal light of China aluminum smelting industry

From the Table 2. the persperity signal light of China aluminum smelting industry, we can see that 7 items out of the 10 items that make up of the industrial climate index, LME aluminum settle price, M2, total amount of investment in smelting, output of electrolytic aluminum, main business income, total profit amount and total amount of extrusion exportation are all stay within the normal zone, only three items like real estate sales, electricity generation and output of alumina d

Rop to the cold zone.

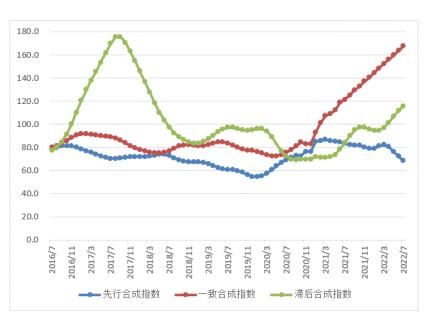

Remarks: blue-leading composite index; red-coincident composite index; green- lag composite index

chart 2 –the curve of the composite index of China smelting industry

The leading composite index drop slightly

In July, the leading composite index was 68.3, decreased by 4%. Please refer to the chart 2 –the curve of the composite index of China smelting industry. Among the 5 items that make up of the leading composite index, there are 4 items dropped from last month after seasoning adjustment, for example, LME settle price dropped by 3.7%, the total amount of investment in smelting dropped by 3.5%, Real estste sales dropped by 4.9% and electricity generation dropped by 0.1%.

chart 3 – the price trend of the main contracted aluminum price of Shanghai Exchange

The operation Characteristics of Aluminum Industrial and situation analysis

In July, the persperity of the aluminum smelting industry generally remained in the upper part of the normal

Zone, the operation characteristics show as below:

1)The aluminum price rebound from its bottom in Jul. Aluminum price rebound in shock after a sharp fall in the first half of Jul. and stopped falling and rose slightly by the end of Jul. In the international market, the aluminum price dropped down as well in early Jul with the great concerned to the strong anticipation that US Ferderal Reserve will increase the interest rate. And aluminum price rebound from lower position with the long capital flowing in; In the domestic market, the aluminum price went down as the covid-19 epidemics repeated and short sentiment dominated the market, aluminum price stop falling and increased slightly by the end of Jul. The main contracted aluminum price of Shanghai Exchange fluctuated between RMB17070-19142/ton, dropped by RMB610/ton by month erlier, 3.2% against end of Jun. please refer to chart 3 – the price trend of the main contracted aluminum price of Shanghai Exchange:

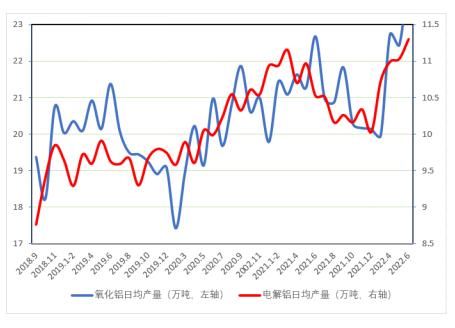

rks:blue line: alumina output (10K tons, left); red line: electrolytic aluminum daily output (10k tons, right)

Chart 4 – the average daily output of aluminum smelting products

2)The total output of the electrolytic aluminum and alumina remained stable and daily output increased by year erlier. With the supply side gradually resumed production, especially the production capacity in Yunan province speeded up resuming the production, pluse the new capacity put into production, the output of electrolytic aluminum gradually increased. In Jun, the total output of electrolytic aluminum in Jun. reached 3,391,000 tons, increased by 3.2% by year erlier; average daily output reached 113,000 tons, increased by 2,700 tons by month erlier, and 1,100 tons by year erlier. the total output of alumina in Jun. reached 7,317,000 tons, average daily output reached 243,000 tons, increased by 20,000 tons by month erlier, and 9,000 tons by year erlier. Please refer to Chart 4 – the average daily output of aluminum smelting products:

3)The aluminum domestic apparent consumption somethimes increased and sometimes decreased.When getting into July, the Covid-19 epidemics in China seems to scatter in many cities and thus have an impact to the peak aluminum comsumption season, the symptoms of the peak season did not appear. Even though Chian government successively introduced a number of faverable policy to stimulate the consumption. And the comsumption in July seem to be become better, but the improvement was not so obvious and the real estate industry is still not good enough and hold the demand from receovery. As it is getting to the flat season, the pace to improve the demand will continuously slow down. If look at the aluminum main consumption field, for example, in the real estate industry, the nationwide real estate investment in June was RMB1618.1billion, dropped by 8.9% by year erlier; the floor space under construction dropped by 2.8% by year erlier, new construction floor space decreased by 34.4% and floor space of building completed fell by 15.3%. In the automobile industry, the production and sales shows to be better than the same time as last year, the production and sales of automobile in June reached 2,455,000 and 2,420,000 respectively, dropped by 1.8% and 3.3% by month erlier respectively, and increased by 31.5% and 29.7% by year erlier respectively. The nationwide output of aluminum extrusion profiles in June was 5,501,000 tons, dropped by 6.7% by year erlier, while nationwide output of aluminum alloy in June was 1,044,000 tons, increased by 11.2% by year erlier.

4)Both the importation of Bauxite and exportation of aluminum extrusion profiles dropped down by year erlier. Due to the poor bauxite endowment in China and the restiction of import and export policy, the inyternational trade of aluminum resource and electriolytic aluminum remained net import. In terms of Bauxite, China imported 9,415,000 tons of aluminum ore and its concentrates in June, decreased by 7.5% by year erlier; Aluminum extrusion profiles remained the new development paradigm featuring dual circulation, in which domestic and overseas markets reinforce each other, with the domestic market as the mainstay. The exportation of unwrought aluminum and aluminum products in June was 591,000 tons, dereased by 50.5% by year erlier.

Overall, under thecondition that the national economy develops in a sustained, stable and coordinated manner, we can forecast that the China aluminum smetling industry will keep operating in the normal zone for the coming a period of time.

Post time: Sep-09-2022